Renmin-LawMeets Transactional Lawyering Boot Camp (2018)

2018-05-12

人大-LawMeets®全英文跨国交易律师技能集中训练营(2018)将会于2018年5月12-18日在中国人民大学法学院举办。本次训练营的宗旨是在一个星期的时间内,通过高质量的集中训练,让训练营学员掌握跨国并购的核心技能。

训练营的特色在于,将会有六名美国Drexel大学法学院的JD同学,与我院学子在同一个教室内接受主讲教师Karl Okamoto教授的授课。JD同学参加本次课程得到了美国律师协会的批准和认证。因此,这是一种把美国JD课堂搬到人大法学院的崭新尝试,具有开拓性的意义。

主讲教师Karl Okamoto教授是美国全国法律谈判大赛--LawMeets®比赛(http://www.lawmeets.com/)的创始人,该比赛吸引了全美顶尖法学院的积极参与。Okamoto教授还是美国律师协会商法教育委员会的前任主席。Okamoto教授亦有丰富的实践经验,担任美国律所合伙人多年。我院主讲教师为姜栋副教授,从事英美法教育和英美法律实践培养十余年。现为英国Selden协会会员。15年获鱼水奖,17年获评人大十大教学标兵。

训练营的培训首先是由姜栋副教授结合有关跨国并购的视频为课程培训打下理论基础(为时一天),然后Okamoto 教授和姜栋副教授利用五天时间进行全面讲授。采取新颖的案例教学方式,鼓励主动讨论,与教授和美国JD同学深层次互动。

授课语言为英语。报名对象为本科生三年级及以上,法律硕士和法学硕士。

此项训练营每年5月均会在我院举办,欢迎同学关注参与。

请将简历发送至cclbootcp@163.com,报名截止日期为4月10日。会根据情况决定是否进行面试。

以下为训练营的英文详细介绍和课表。

What is the Renmin-LawMeets®Transactional Lawyering Boot Camp?

“Boot camp” is the nickname of United States Marine Corps Recruit Training, a program of initial training that each recruit must successfully complete in order to serve in the United States Marine Corps. Marine boot camp is extremely challenging – both physically and mentally – considered to be tougher than the basic training programs of any of the other military services.

The Renmin-LawMeets®Transactional Lawyering Boot Camp, patterning after the Marine boot camp, trains students in practical lawyering skills in English intensively in a one-week program. The program is offered each summer in May at Renmin University of China Law School.

Who will lead the Renmin-LawMeets®Transactional Lawyering Boot Camp?

The bootcamp is co-chaired by Professor Karl Okamoto, who is the Director of the Business and Entrepreneurship Law Program at Drexel University’s Thomas R. Kline School of Law and Jiang Dong (姜栋), associate professor of Renmin Law School.

Professor Karl Okamotois one of the leading experts in the US in transactional skills training, having founded the LawMeets®program. Prior to joining the Drexel faculty, he was a partner at Kirkland & Ellis LLP and Dechert LLP.

Associate Professor. Dong Jiang, Renmin University of China Law School. He has been teaching Legal English, Legal Writing and Legal Reasoning, Contract Drafting and Negotiation for 13 years. He deeply understands the know-how for Chinese students to read, write, translate and speak like a lawyer in English.

What is the topic for the Boot Camp?

In 2016 in China for the first time outbound mergers and acquisitions activity exceeded inbound activity. Chinese private equity firms are now the second most active in the world, buying more and more companies in the US and Europe. Examples include Golden Brick Capital and Henry Cai’s AGIC Capital. More and more Chinese multinational law firms are assisting their clients in managing the acquisition process in the US and EU, rather than acting only as local counsel in China.

Based on a case written by Professor Okamoto, students will be asked to perform a series of simulation exercises around drafting and negotiating an acquisition agreement. In addition, Professor Okamoto will also give lectures on the equity arrangements, the financing and the arrangements with management that are part of issues raised in the process of a typical private equity transaction.

What you need to know about the case of Renmin-LawMeets®Transactional Lawyering Boot Camp (2018)?

BGI is a fictional Beijing-based private equity investment firm. Its strategy is to invest in privately-held companies based in North America or Europe that can benefit from BGI’s network and expand their businesses in China. BGI has recently entered into a letter of intent to acquire Volt Process Design Company, a process control software company based in Philadelphia. Volt is currently owned by members of the Richards family. Rachel Richards, the daughter of Volt’s founder, is Volt’s CEO. In the deal, BGI is investing US$750M of equity. They are also arranging over US$1.35B of financing. In exchange for their shares in Volt, the Richards family will receive $2B in cash and an ongoing ownership interest in the company.

In the boot camp, students will draft and negotiate the critical provisions for this transaction.

What is the timetable?

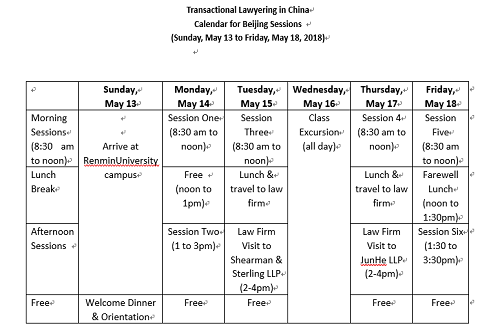

The boot camp will take place over one week, May 12-18, 2018 (with one day off for an optional group excursion on May 16). During the week, there are two sessions (morning and afternoon). The class will take place at Renmin Law School, and include visits to two major multinational law firms in Beijing. It is expected to be asmall-class (20 students at maximum). Six students from Drexel University law school will be participating in the course.

Who is qualified to apply for?

Undergraduates in the year of [2015] or above, LLM and JM

Fluent in English

Interested in M&A practice

How to apply?

Send your CV (English) to cclbootcp@163.com by April 10th, 2018. Please introduce yourself briefly and highlight your merits in the email. There may be an interview to finalize the list of participants.

中国人民大学普通法中心

Centre for Common Law Renmin University of China

March 25, 2018

Appendix: Course Schedule

Session Descriptions

Monday

Session One

• Professor’s Presentation (60 minutes): Overview of the deal and the deal process; letters of intent; exclusivity; confidentiality; due diligence.

• Break (30 minutes)

• Team Exercise (120 minutes): Drafting a Confidentiality Agreement – teams will draft and negotiate a confidentiality agreement.

Session Two

• Professor’s Presentation (120 minutes): Purchase prices provisions; working capital adjustments; earn-outs; representations & warranties; materiality; valuation.

Tuesday

Session Three

• Professor’s Presentation (60 minutes): Covenants; closing conditions; regulatory approvals; termination; reverse termination fees.

• Break (30 minutes)

• Team Exercise (120 minutes): Drafting a Reverse Termination Fee clause – teams will draft and negotiate a reverse termination fee arrangement.

Law Firm Visit

• We will be visiting the Beijing offices of Shearman & Sterling LLP. Our host will be Lee Edwards, Esq.

• During our meeting, we will be discussing the impact of regulatory approvals on Chinese outbound M&A and US-China law practice in general.

Wednesday

We are planning on taking a trip to visit the Great Wall (weather permitting). Details will be announced.

Thursday

Session Four

• Professor’s Presentation (60 minutes): Indemnification; choice of law; dispute resolution; arbitration.

• Break (30 minutes)

• Team Exercise (120 minutes): Planning for failure – teams will outline the potential dispute scenarios under the acquisition agreement and counsel their clients on the various strategic choices.

Law Firm Visit

• We will be visiting the Beijing offices of JunHe LLP. Our host will be Henry Shi, Esq.

• During our meeting, we will be discussing dispute resolution and choice of law in cross-border M&A and US-China law practice in general.

Friday

Session Five

• During our final day, students will participate in an extended team exercise focused on the risk of US government approvals (i.e., CFIUS) in the BGI-Volt transaction. During Session Five, teams will be asked to draft proposed provisions for the acquisition agreement to address the issue, meet with their clients to discuss the issue and proposed provisions, and negotiate with opposing teams to reach a mutual solution.

Session Six

• In Session Six, teams will take turns presenting their final draft provisions to the class. Professors and class members will provide feedback. The class will conclude with a wrap-up discussion of the week’s sessions.

- 1103月

- 2025年中国人民大学法学院国际商事交易...2025-03-11

- 2110月

- 【普通法系列讲座】Offshore Fa...2024-10-21

- 2305月

- 【普通法系列讲座】Trust Law D...2024-05-23

中国人民大学普通法中心办公室:

中国人民大学普通法中心办公室: